Mortgage Blog

Winnipeg and Manitoba Mortgages Made Easy

The Hard Truth About Mortgages in Canada [April 2024]

April 17, 2024 | Posted by: The Spooner Group

The Hard Truth About Mortgages in Canada [April 2024]

Listen – we’ve seen a lot over the years. The ups and downs. The surprises. The highs seeing people succeed. The lows of turning away clients.

As we sit in April 2024, there’s a lot of uneasiness out there and we want to bring you back into reality.

If your only sources of information about the mortgage and housing markets are the Bank of Canada, mainstream media, and our government, here’s a wake-up call:

None of them have your best interests at heart.

You Can’t Trust Them (Here’s Why)

You can’t rely on those in authority for your wellbeing anymore. Those days are gone.

They’ve proven themselves unreliable for the individual Canadian that wants to build their life and family.

We’ve seen for years how poor fiscal policies have negatively impacted our economy. Those policies have had some harsh impacts on many of us.

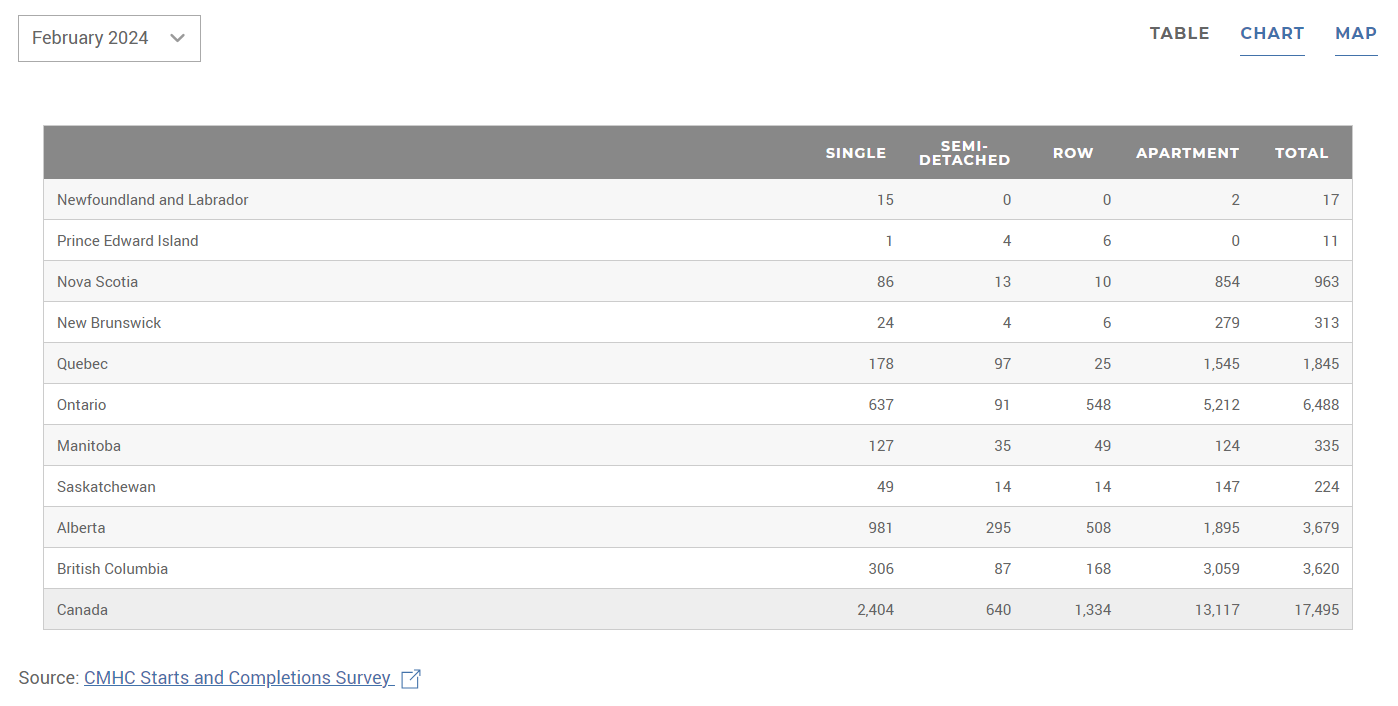

It’s April 2024 and we still have low housing starts, a shortage of available homes, increases in the number of newcomers even with a housing shortage (this is negatively impacting the newcomers themselves), and of course the high inflation rates that are still above target after 2+ years.

What Happens Next?

Translation? Many Canadians are finding the ‘ideal life’ that much more unattainable.

With all this going on, it’s completely normal to have some worries about what it means for you and your financial situation.

Whether you’re a homeowner already, thinking about buying, up for renewal soon, or just trying to make sense of it all, it’s essential to look out for yourself.

You can no longer rely on those in positions of power to have your back.

We hope you know that we are not like them. We actually do care about your situation because we're right there with you – feeling the uneasiness while trying to build a good life for ourselves and our families.

Whether you’ve worked with us before or you came across us online talking about mortgages and housing – we're here for you..png)

Your Path Forward

Seriously, don’t hesitate to reach out if you have questions, concerns, or just need someone to chat with about your situation.

Things are tough. But it’s the tough times that build character. It’s the tough times where people can find opportunities.

Narrow may be the path but it’s still there and it’s the best path forward for you and your goals.

That’s the hard truth about mortgages in Canada in April 2024.

It may be more difficult to get into the market for the first time, but it’s not impossible.

Your best bet is to NOT listen to those in authority, but trust your instincts and get professional help from someone who is in the space with you. Someone who has direct knowledge and experience.

Hope you can trust us for that.

Thanks for the read. Until next time.

FYI: The Spring Market is looking quite lively. With the anticipated rate cuts this year, there’s movement. And where’s there’s movement, there are opportunities. Buying, Selling, Renewing, Refinancing – don’t make any decisions without guidance first.

Blog Categories

Have Questions?

Not Sure Where To Start?

Let's schedule a quick call.

Zero-hassles and zero-obligation.